*Disclaimer: Meow Technologies is a financial technology company, not a depository, bank or credit union, and your account at Meow is not, itself, an FDIC-insured product.

Meow currently partners with three banking providers. Banking services are provided by Third Coast Bank SSB; Member FDIC, Grasshopper Bank, N.A; Member FDIC, and FirstBank, a Tennessee corporation; Member FDIC.

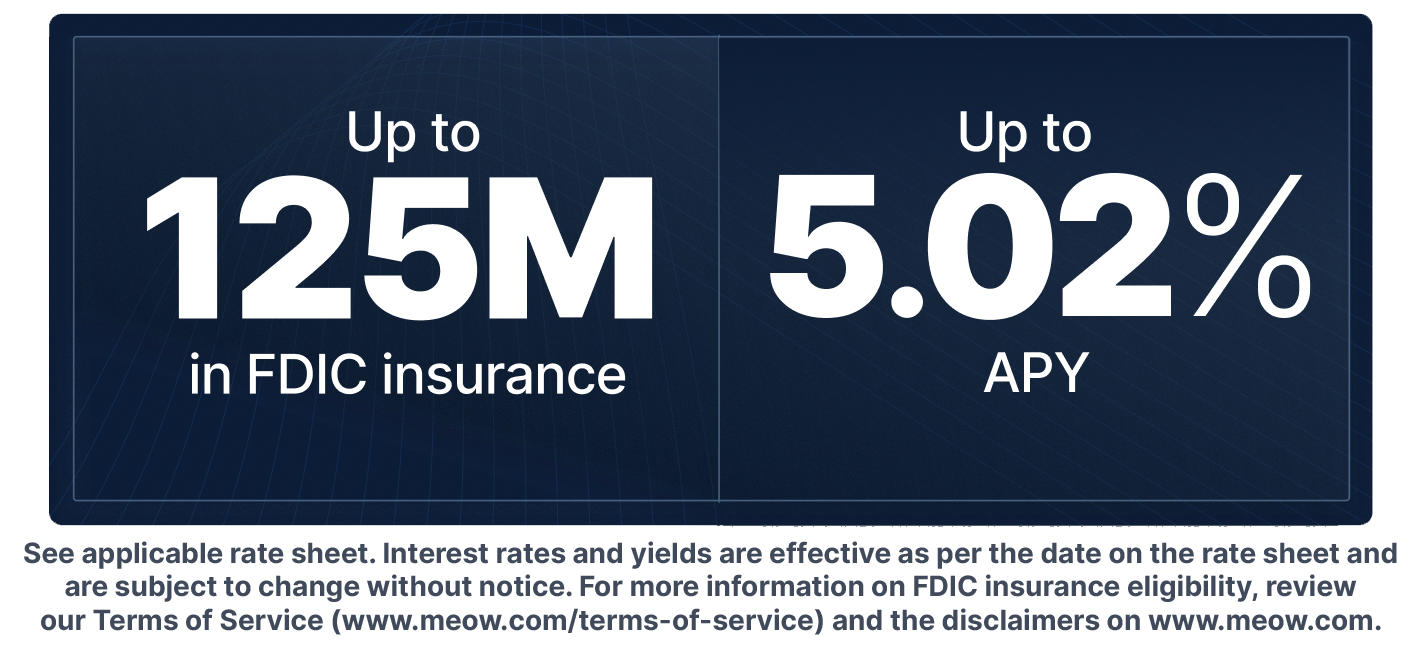

By opening a Maximum Checking account through Meow and if you choose to receive banking services provided by Grasshopper Bank, N.A, you deposit your funds into a deposit account at Grasshopper Bank, N.A. which sweeps those funds into deposit accounts across a network of Federal Deposit Insurance Corporation (“FDIC”)-insured banks, for up to the current standard maximum deposit insurance amount (“SMDIA”) of $250,000 per eligible depositor, per destination institution, for each ownership capacity or category, subject to applicable terms and conditions, including Grasshopper's ICS Deposit Placement Agreement. Grasshopper Bank, N.A. uses a third-party vendor and agent to help administer this sweep process. Visit https://www.intrafi.com/network-banks/ for a list of the banks and savings associations with which we/Grasshopper, N.A. have a business relationship for the placement of deposits at destination institutions, and into which your deposits may be placed (subject to applicable terms with you, and any opt-outs by Grasshopper, N.A. or you). Your funds are protected with up to $125 million in FDIC insurance through the sweep network of Grasshopper Bank, N.A, subject to change at any time with notice from Meow. Terms and restrictions apply. Subject to applicable rate sheet. Interest rate on checking products quoted in Annual Percentage Yield (APY). Interest rates and yields are effective as per the date on the applicable rate sheet. See applicable terms and restrictions and refer to the applicable rate sheets for additional information.

By opening a Maximum Checking account through Meow and if you choose to receive banking services provided by Third Coast Bank SSB, you deposit your funds into a deposit account at Third Coast Bank SSB. If you also hold funds in a sweep program with Third Coast Bank SSB, Third Coast Bank SSB sweeps those funds into deposit accounts across a network of FDIC-insured banks, for up to the current SMDIA of $250,000 per eligible depositor, per receiving bank, for each ownership capacity or category, including any other balances you may hold at that receiving bank directly or indirectly through other intermediaries, including broker-dealers. Third Coast Bank SSB uses a third-party vendor and agent to help administer this sweep process. Visit Third Coast Bank SSB for a list of the banks and savings associations with which we/Third Coast Bank SSB have a business relationship for the placement of deposits at receiving banks, and into which your deposits may be placed (subject to applicable terms with you, and any opt-outs by Third Coast Bank or you). Your funds are protected with up to $50 Million in FDIC insurance through the sweep network of Third Coast Bank, subject to change at any time with notice from Meow. Terms and restrictions apply. Subject to applicable rate sheet. Interest rate on checking products quoted in Annual Percentage Yield (APY). Interest rates and yields are effective as per the date on the applicable rate sheet. See applicable terms and conditions and refer to the applicable rate sheet for additional information.

By opening a Maximum Checking account through Meow and if you choose to receive banking services provided by FirstBank, a Tennessee corporation, you deposit your funds into a deposit account at FirstBank, which sweeps those funds into deposit accounts across a network of FDIC-insured banks, for up to the current SMDIA of $250,000 per eligible depositor, per destination institution, for each ownership capacity or category, subject to applicable terms and conditions, including FirstBank's ICS Deposit Placement Agreement. FirstBank uses a third-party vendor and agent to help administer this sweep process. Visit IntraFi for a list of the banks and savings associations with which FirstBank has a business relationship for the placement of deposits at destination institutions, and into which your deposits may be placed (subject to applicable terms with you, and any opt-outs by FirstBank or you). Your funds are protected with up to $125 million in FDIC insurance through the sweep network of FirstBank, subject to change at any time with notice from Meow. Terms and restrictions apply. Subject to applicable rate sheet. Interest rate on checking products quoted in Annual Percentage Yield (APY). Interest rates and yields are effective as per the date on the applicable rate sheet. See applicable terms and restrictions and refer to the applicable rate sheet for additional information.

FDIC insurance coverage is only available to protect you against the failure of an FDIC-insured bank that holds your deposits (and does not protect you against the failure of Meow or other third party). Your account with Meow and all services provided to you are subject to the Meow Terms of Service (“Account Agreements”) and other applicable terms and no other representations or warranties, express or implied, are provided to you except as expressly set forth in those written Account Agreements. If you have any questions regarding your account, please contact team@meow.com.